Non-residents may invest in the Republic, provided that suitable documentary evidence is received in order to ensure that such transactions are concluded at arm’s length, at fair market-related prices, and are financed in an approved manner.

Financial assistance in South Africa

- Emigrants: local financial assistance made available to emigrants is subject to the 1:1 ratio.

- Non-residents: authorised dealers may grant or authorise local financial assistance facilities to non-residents in respect of bona fide foreign direct investments into South Africa without restrictions. Where the funds are required for the acquisition of residential property or other financial transactions, the 1:1 ratio will apply.

- Affected persons (i.e. where non-residents directly or indirectly own 75% or more of an entity): there is no restriction on the amount that could be borrowed locally in instances where an affected person wishes to borrow locally to finance a foreign direct investment into South Africa or for domestic working capital requirements. Wholly non-resident owned subsidiaries may borrow locally up to 100% of the total shareholders’ investment, in respect of the acquisition of residential property and or other financial transactions. The effect of local participation in non-resident controlled entities is to make the abovementioned norms more liberal the greater the local participation, i.e. the ability to borrow locally increases. This is based on a formula.

Loans from non-resident shareholders to residents

Applications for proposed borrowing abroad by residents must be referred to the Financial Surveillance Department for approval.

Capital transactions

Proceeds from the sale of assets in South Africa, may be remitted abroad. Proceeds on the sale of assets by emigrants will be subject to the blocked account provisions.

Dividend payments to non-residents

Dividends declared by companies are remittable to non-resident shareholders in proportion to percentage shareholdings, subject to certain restrictions if the dividend is declared by an affected person who has local financial assistance. An emigrant shareholder will be entitled to dividends declared out of income earned from normal trading activities after the date of emigration. Non-listed companies have additional requirements to be met in order to transfer such dividends. Dividends declared out of capital gains, or out of income earned from normal trading activities prior to the date of emigration, remain subject to the blocked account provisions.

Director fee payments to non-residents

Authorised dealers may transfer director’s fees to non-resident directors permanently domiciled outside South Africa, provided the application is accompanied by a copy of the resolution of the board of the remitting company, confirming the amount to be paid to the beneficiary.

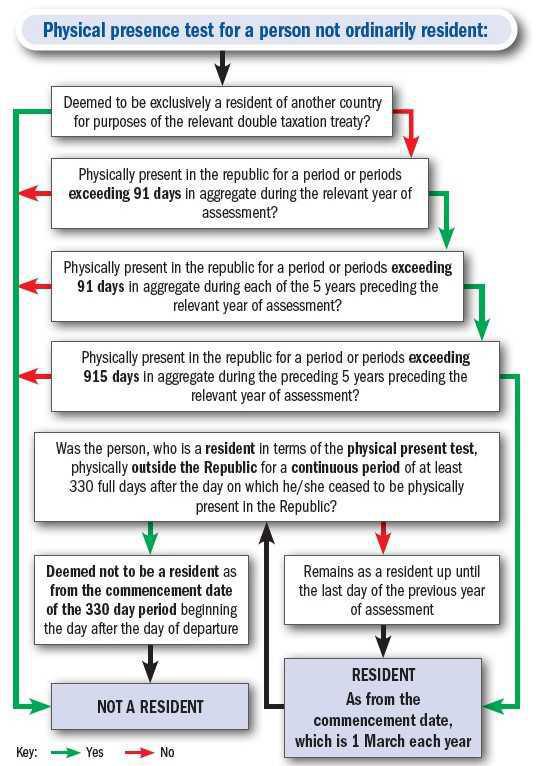

Ceasing to be a resident

When a person ceases to be a resident, certain tax consequences are triggered. A trust or natural person that ceases to be a resident must be treated as having disposed of all their assets for market value immediately before they ceased to be a resident.

A company that ceases to be a resident will also be treated as having disposed of all its assets for market value immediately before it ceased to be a resident. In addition the company will be deemed to have paid a dividend on the difference between the market value of all the shares of the company and the contributed tax capital of the company.

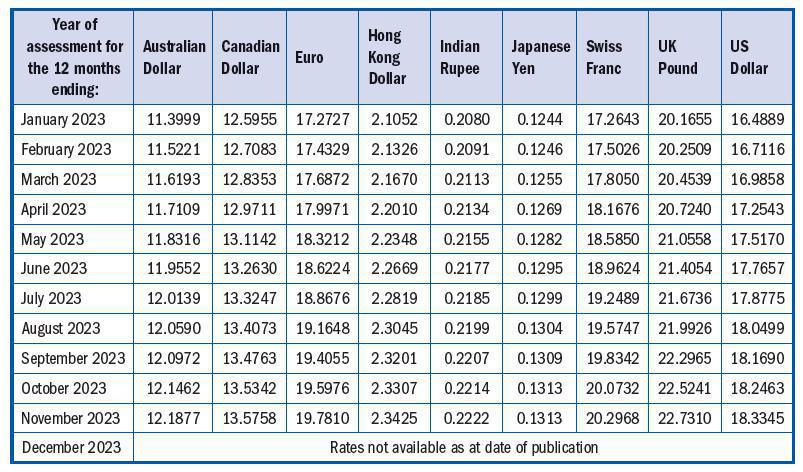

Average exchange rates for a year of assessment