Financial years ending on any date between 1 March 2025 and 28 February 2026

Financial years ending on any date between 1 March 2024 and 28 February 2025

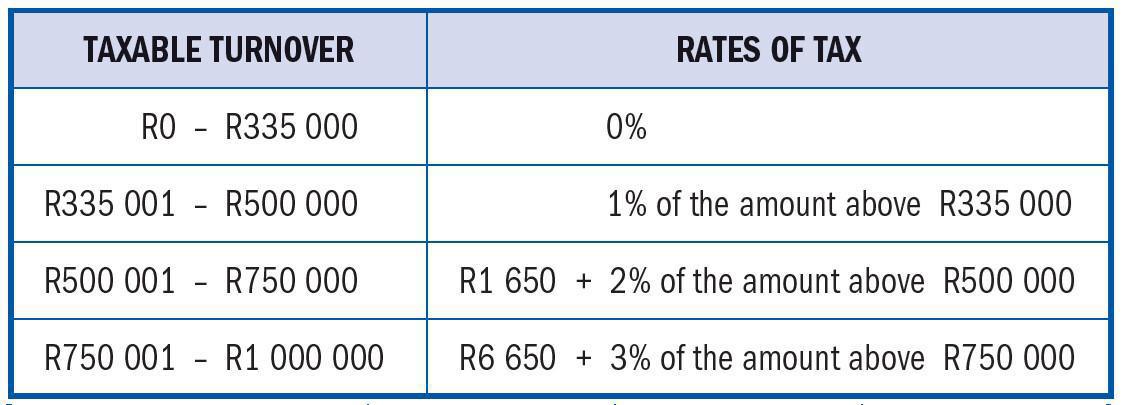

Turnover tax for micro businesses is a simplified turnover-based tax system substituting income tax and Capital Gains Tax. A micro business may voluntarily register for VAT. Turnover tax is an elective tax applicable to sole proprietors, partnerships and companies that meet certain criteria and have a turnover of less than R1 million per year.

A micro business may only voluntarily exit the turnover tax system before the beginning of a year of assessment.